Charitable Giving Through Estate Planning

Table of Contents

Leaving a Legacy

How to Give to Charity as a Part of an Estate Plan

One-Time Distributions at Death

Long-Term Distributions During Life & After Death

Charitable Giving Through Use of Charitable Trusts

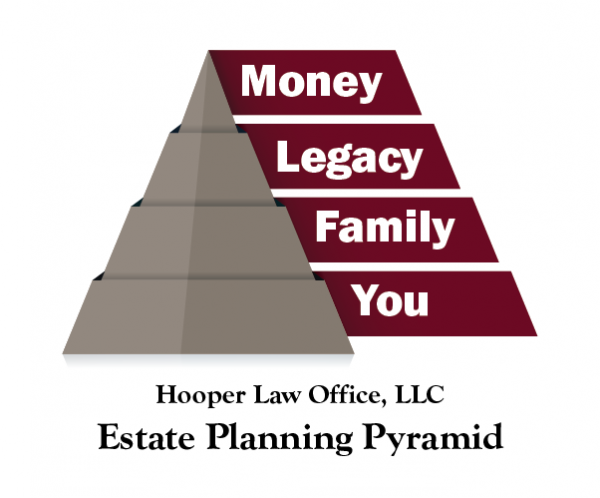

The foundation of any client’s Estate Plan is to first support and plan for the client and then to support and provide for their family and loved ones, as shown in the Hooper Law Office Estate Planning Pyramid. Once we know that the Estate Plan accomplishes those first two priorities, the next focus is framing the client’s legacy.

The foundation of any client’s Estate Plan is to first support and plan for the client and then to support and provide for their family and loved ones, as shown in the Hooper Law Office Estate Planning Pyramid. Once we know that the Estate Plan accomplishes those first two priorities, the next focus is framing the client’s legacy.

Attend Our Upcoming Complimentary Estate Planning Seminar

Leaving a Legacy

Every client has a different understanding of what legacy means and how it should be represented in their Estate Plan.

For some, their legacy is a family farm that was built from nothing and has been passed down for generations. Others prioritize planning to preserve the family cabin that has housed countless celebrations and special moments. For those that are charitably minded, legacy planning includes supporting community involvement and nonprofit organizations.

How to Give to Charity as Part of an Estate Plan

Charitable giving in an Estate Plan can take different forms. Most commonly, the planning falls in one of two categories. No matter how you choose to donate, you should also be aware of how to do so in the most tax-efficient manner.

- The client wants to directly benefit an entity only at the time of death so designates funds to one or more charities and those funds are distributed directly from the client’s estate to the charity.

- The client wishes to support charities or philanthropic causes over an extended period of time rather than a one-time distribution at the time of death.

One-Time Distributions at Death

The goal of a one-time distribution from the client’s estate can be realized in a few different ways. The main differentiators are the identity of the decision-maker and whether or not there are decisions to be made at the time the estate is administered. Some clients want to choose the total amount of the estate that will be distributed to charitable entities, which charities are to receive a distribution, how much each individual charity will receive from the estate, and, in some cases, how the money must be used by the charity after the distribution is made. However, some clients prefer to leave some of the decisions up to the charity as to how to use the donation, or they may also leave options up to their loved ones to encourage them to prioritize philanthropy in their own lives.

Example 1: Distributions Entirely Directed by the Client

The first option is one where all of the control is with the client. The charitable distributions are made from the estate after the client has passed away. In the Estate Plan, the client designates the total amount from the estate that is to be distributed to a list of named charities, and the client also instructs what amount is to be given to each separate charity from the charitable share.

Often, the charities have held special significance to the client and/or the client’s family. The client may have also financially supported the charities during life. Either way, the charitable legacy is a representation of the client’s life and the charities or charitable causes that are important to the client.

The client may also specify money be distributed to a charity only to support certain activities or certain aspects of the entity. For example, the client may leave funds to the grade school the client attended but specifies that it be used to support the school band, the choir, or the art program, or perhaps the client specifies the money create a scholarship of some sort. Although the client selects an organization or charitable entity to receive the distribution, the client also has particular wishes as to how the money is used. This can be a great tool for a client to ensure

Example 2: Beneficiary Directed Giving

Another method of a one-time designation of charitable planning incorporates your loved ones into the philanthropic process. Rather than specifying the charity or the charitable causes to be supported by your estate, the decision-making is passed to your loved ones, and the loved ones select the charities.

You can specify the amount to be donated and can limit the charities or causes as much as you would like. For example, there can be limitations on the cause of the charity, such as medical research, animal cruelty, education, etc., or there can be criteria that the charity must satisfy to be eligible to receive a distribution, such as the charity being a 501(c)(3) under the IRS code or the charity residing within a set geographic region.

The hope is that the loved ones will see the impact that philanthropy can have on the community and be inspired to do more philanthropic work on their own.

Example 3: Beneficiary Involved Giving

If you wish to support a specific charity or charities but also want your loved ones to be involved, your Estate Plan can combine the paths in this category. You can provide a list of acceptable charities, and your loved ones are then allowed to choose among the set list provided.

Conversely, you can also designate a list of charities and require that all charities on the list receive some amount from the estate. However, the individuals you have designated then decide how the amount specified for charities is to be divvied up. This gives you control over which charities are to be supported by your estate but still involves your loved ones in the process.

Long-Term Distributions During Life & After Death

Rather than a one-time distribution from the client’s estate to a charity, the client may prefer to support a charity over a long period of time.

Beyond the fulfillment of giving back to the community or satisfying tithing obligations, there can also be monetary advantages for the client and/or the client’s estate through Charitable Planning. The monetary benefits usually take the form of tax savings, including income taxes, estate taxes, capital gains taxes, etc. The kind of tax savings depends on the type of planning done and whether the taxes are saved during the client’s life or after the client’s death.

Any method of tax planning utilizing charitable giving must start from the question of whether or not the client is charitably minded.

If the client does not have an interest in charitable giving, despite any tax savings we may be able to include in the Estate Plan, Charitable Planning is not the appropriate way to plan for that client. However, for clients that prioritize supporting charities, there can be tax savings created through Estate Planning.

Without Using Trusts

There are a few ways you can take advantage of being charitably minded with regard to taxes, but two of the most common we tend to discuss with our clients are charitable itemized deductions and as a method of taking a mandatory distribution from a retirement account. Both of these options are capable of being used each year, and they do not have to be part of any longer-term planning in order to work well. Usually, these options are ones you elect each year based on your income and a desire to reduce your taxable income for that tax year.

Charitable Deduction

Donating money, assets, services, property, etc. is a common way to reduce the amount of income a person must claim over the course of a year. However, using a donation to reduce income must be done through the itemization of taxes. Therefore, each person must calculate whether itemizing donations (and other deductions that may apply) provides a greater benefit than electing to take the standard deduction. For most people, there is not enough value in itemizing to result in a value that exceeds that of the standard deduction. However, for those that have enough itemized deductions to exceed their standard deduction, charitable donations can be a tax benefit.

There is also a maximum percentage of a person’s adjusted gross income limitation on donations. If the donation exceeds the percentage, then the overage cannot be used as a deduction. However, the donation can be used up to the maximum percentage, it is just the overage that is not allowed to be used for a charitable deduction.

Mandatory Distributions from Individual Retirement Account

If you have saved for retirement using pretax accounts, you will be required to begin drawing money out of those accounts at a certain age as your mandatory distribution. However, not everyone needs their distributions at that point, and some have, unfortunately, neglected to plan for the distributions to minimize their overall tax impact. Charitable contributions, if done correctly, can reduce the tax burden. As stated earlier, this type of tax savings method is usually a better fit if you are already charitably minded.

Charitable Giving Through Use of Charitable Trusts

There are many, many different types of Trusts, and there are several types available for charitable planning. We are going to examine three different Trust-based options to plan for charitable giving, some during life and some after death. The three types of Trusts we will review are the three most common types of Trusts used to plan for charitable donations:

- Revocable Living Trust with a Charitable and Non-charitable Share Allocation

- Charitable Remainder Trust

- Charitable Lead Trust

The charitable entities discussed must qualify under the tax code in order to qualify your plan as you intend. However, these charities can include private foundations you establish to support your charitable endeavors or to support the charities you find most important. If establishing a private foundation is a little more involved that you would like, using community foundations and their Donor Advised Funds can give you the same functionality as a private foundation without the cost of set up and continued administration.

Revocable Living Trust with a Charitable and Non-charitable Share Allocation

Although this option does not provide any specific tax savings to you as the grantor (the person that set up the Trust), it is by far the most common type of charitable planning done with Trusts. Essentially, this is the option usually used by a person who wants to provide distributions to charities simply because that is a priority to the person outside of any tax benefits, but the person also wants to provide the distributions in a tax-efficient manner.

Using a Revocable Trust allows your family to avoid going through the Probate process while still having a plan in place that they can follow. You are able to change the Trust or get rid of it altogether whenever you wish. In your revocable Trust-based plan, you can also plan for charitable distributions. After bills and final expenses have been paid, you can have your Trust separate into a charitable share and a non-charitable share. By doing so, you can provide for multiple charitable beneficiaries and multiple individual beneficiaries.

Related Article: The Dangers of Beneficiary Designations

You can also ensure that the charitable distributions are specifically satisfied using assets with certain tax amounts that must be satisfied by the recipient. Charities, in general, do not have to pay income taxes or capital gains taxes, so they are not disadvantaged by the receipt of an asset that has those types of taxes associated with it. However, you must be very specific in the language of the charitable designations to take advantage of this planning. This language can only be included as part of an Estate Plan, such as a Will or a Trust, and cannot be communicated by just using a Beneficiary Designation.

You can also create safeguards if you have concerns that your overall estate may be depleted during your life because of health issues, nursing home stays, economic changes, or simply because you decide to spend your money on you. If you want the size of your estate at the time of your death to determine the total amount going to charity rather than making these decisions based on the total amount of your estate now, using a Trust with this method of administration can make things much easier.

You can also use hurdles to protect your individual beneficiaries or simply base the charitable distributions on percentages. For example, perhaps you only want the section on charitable distributions to trigger if the size of your estate at death is at least a million dollars. If your estate is below your stated threshold, only the non-charitable beneficiaries, such as your family, will take from your estate.

You can also use percentages to protect your individual beneficiaries or your charitable ones. By having all the assets in your estate being consolidated together, you can select one percentage for your entire estate that determines the amount going to each type of beneficiary. You can count on your intention being honored because the plan will work as designed no matter how your assets may change, where your accounts are held, or who may be in charge of your estate because of incapacity. In the end, your estate will be divided with the same percentages applied to each asset.

Charitable Remainder Trust

A Charitable Remainder Trust provides tax benefits to you as the grantor (person who sets up the Trust) during your lifetime. Again, this is best used by a person who is charitably inclined already, but, if you have charitable intent, you can do so in a way that is tax strategic.

Essentially, you establish a Trust during your life. In establishing the Trust, you commit to the assets that remain in the Trust after your death or after a selected number of years going to one or more charities. Until that time though, you are able to receive annual distributions from the Trust assets. You are also able to take advantage of a tax deduction for each year, despite receiving the distributions, because of your commitment to the Trust balance going to charity.

The beneficiaries after death can only be charities that qualify as such under the IRS code, so you are not allowed to include any individuals, such as family or friends as residuary beneficiaries. People that use this type of Trust usually have more than one Trust or plan in place. Some of their assets are directed to family and friends through another method. By planning in this way, you are able to include charities in a manner that provides tax benefits to you while having another plan to leave other assets to your individual beneficiaries. You can get the best of both worlds.

If you are interested in considering this type of planning, it is important to discuss your interest with your professional advisors. You want to understand what the benefits will be to your and your heirs and verify they justify the complexity in the planning. You also need to be certain about your commitment to the Trust assets going to charity because there can be serious tax ramifications if you alter the plan in a way that redirects the assets.

Charitable Lead Trust

A Charitable Lead Trust is sort of the opposite of the Charitable Remainder Trust. This is another plan where you are making a commitment to benefiting one or more charity. The charities must also qualify as charitable entities under the IRS code. If the planning is done correctly, you are able to take advantage of tax savings during your life.

You establish a Trust and transfer the assets you have selected to the Trust. You commit to a certain amount being annually distributed from the Trust. Hopefully, this amount is able to be satisfied using the income that has accumulated over the course of the year, but the full distribution must be made regardless of whether or not the income has kept up with the obligation. This means that you may end up losing portions of principal if the investments are not able to keep up with the commitment, and there are, of course, specific requirements as to the minimum amounts you must commit as distributions.

You are able to get the advantage of the tax donation each year to the charity or charities of your choosing. At your death, the remaining assets in the Trust go to the individual beneficiary or beneficiaries of your choosing. Essentially, during life, you are making consistent donations to charities that you wish to support and receiving a tax break to do so, and then the money goes to your family as you choose after you have passed away. With this type of Trust, you are also able to do some of the customization and support of your heirs learning about philanthropy that we discussed above.

This is also another type of Trust that tends to be used in conjunction with other planning or Trusts. If you are consistently giving to charity as it is, this type of Trust can potentially give you more tax advantages than what you may have available through itemizing.

If you think that this method of planning may be an advantage for you, it is important to discuss it with your team of professional advisors. An experienced Estate Planning Attorney can explain how the Trust would work and how to fit it into your overall plan. Your tax advisor can provide insight into what advantage you may receive by using a Charitable Lead Trust that you are not able to get through other tax planning options and can explain the minimum amount you should expect to distribute each year. Your financial advisor is then able to plan with you on how to manage the investment side of things to avoid having to invade principle to make the annual distributions, and you can feel confident that your annual distributions will likely be made with income and no or a minimum of principle.

Conclusion

As you can see, there are a plethora of options out there regarding charitable planning, and many of the options you have can also provide you or your heirs with various types of tax savings. However, the decision as to whether or not to implement these options is very personal and specific to your situation. It is vital to discuss your thoughts and questions on these planning tools and techniques with your professional team of advisors.

The tax benefits are based on your circumstances and unique to your tax situation. You cannot evaluate the benefits and/or detriments of any particular plan without understanding how your personal taxes fit into the picture. Your tax advisor can explain your current situation and compare it to your use of any of the charitable planning methods we have discussed.

Your financial advisor can discuss your investments with you and identify which of your assets would be available for any of the planning options you may be considering. If you do not have assets that currently fit the plan you would like to consider, your financial advisor could also review the options you may have of converting your current assets into assets that would qualify. Once the plan is implemented, you will also need their advice on maintaining the financial viability of the planning, ensuring you can support both your desired charities and loved ones.

Finally, the last advisor on your team, and we would argue the most important, is the experienced Estate Planning Attorney. Our role is helping to review all of the planning tools available with you, reviewing the tax evaluation by your tax advisor, reviewing your asset information provided by your financial advisor, and assisting you designing the plan that works best for you (and a spouse), your loved ones, your charitable interests, and your tax and Estate Planning goals.

Learn about Estate Planning Options at Our In-Person Educational Event